Consumers Can Increase Their Credit Score Knowledge by Taking the Credit Score Quiz (CreditScoreQuiz.org)

NOTICE: PRESS TELECONFERENCE TODAY

June 10, 2019 12:00

NOON EASTERN

CALL IN NUMBER: 800-247-5110 PASSCODE:

CFACALL

WASHINGTON--(BUSINESS WIRE)--The ninth annual credit score survey, released today by the Consumer Federation of America (CFA) and VantageScore Solutions, LLC, shows that consumer knowledge about credit scores is at the lowest level in the past eight years. On most knowledge questions (as the enclosed table and charts show), correct scores declined by more than ten percentage points, and sometimes by more than 20 percentage points. For example:

- 78% of respondents in 2012, but only 62% in 2019, correctly indicated that people have more than one credit score.

- 85% in 2012, but only 66% in 2019, correctly answered that keeping a low credit card balance helps raise a low credit score or maintain a high one.

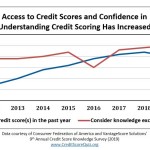

However, in the same period, the proportion of respondents who said they considered their knowledge of credit scores excellent or good rose from 54% to 60%.

“Consumers know less about credit scores but think they know more,” said Stephen Brobeck, CFA senior fellow. “Taking our online credit score quiz provides an easy way for consumers to update their credit score knowledge,” he added. More than 230,000 individuals have taken the Credit Score Quiz, developed and maintained by CFA and VantageScore.

“We are pleased that many consumers now have free access to their credit scores, but consumers must also take advantage of all the additional information about credit scores and credit files in order to make better credit decisions,” said Barrett Burns, president and CEO of VantageScore Solutions.

Consumer knowledge levels may have deteriorated, in part, because of improvements in the overall economy and consumers’ financial condition. In 2012, large numbers of Americans faced challenging credit card and mortgage debts, so consumers may have been especially concerned about credit scores. Since then, as the nation’s economy and family finances recovered, and as consumers reduced unsustainable credit card and mortgage debts, consumers may have felt that it was less important to fully understand credit scores. Reports of increases in average credit scores nationwide may also have lessened people’s feelings of financial vulnerability and the need to fully learn about their scores and its impact.

Despite overall rising score levels – now averaging 680 according to Experian – a large minority of consumers have fair or poor scores (below 670). Low scores can especially harm these people by:

- Denying them access to needed credit.

- Increasing the costs of consumer and mortgage credit they can obtain. Subprime auto loans will likely cost several thousand dollars more, and subprime mortgage loans can cost over ten thousand dollars more, compared to conventional loans.

- Increasing deposits required by utilities and cell phone companies to obtain service.

Low credit scores also are an indicator that people may have difficulty obtaining a job. While credit scores themselves are not used by employers, the credit reports the scores are based on are frequently utilized. “Those with low credit scores should be aware that they are at risk not only for paying higher costs for credit and utility services, but may also struggle to obtain a good job with which to afford those higher costs,” noted CFA’s Brobeck.

While consumers’ knowledge of their actual credit scores has declined overall, the latest survey shows large majorities of consumers did correctly answer key knowledge questions related to important facts:

- Mortgage lenders and credit card issuers use credit scores (83% and 82% respectively).

- Missed payments are used in calculating credit scores (86%).

- Making all loan payments on time helps a consumer raise a low credit score or maintain a high one (87%).

However, significant minorities of respondents did NOT know other key facts, for example:

- Cell phone companies might use credit scores in pricing services (41%).

- Borrowing from a 401k retirement account or paying a parking ticket late will not lower your credit scores (30% and 22% respectively).

- Opening several credit card accounts at the same time might lower scores (38%).

- Frequently checking credit scores will not lower their scores (38%).

- Checking the accuracy of one’s credit reports is very important (33%). Lenders may have provided inaccurate information or failed to supply accurate information to credit bureaus; thus, the bureaus may have made mistakes such as adding information to the wrong file of a person with the same name.

In brief, consumers can raise their credit scores or maintain high scores by:

- Consistently making loan payments on time every month. A late payment may lower one’s credit scores by dozens of points.

- Using a small portion of the credit available on a credit card. In general, the higher the percentage of credit line that is drawn down, the lower one’s credit scores.

- Paying down credit card debt rather than just shifting it to another credit card or to a home equity loan.

- Regularly checking one’s credit reports to make sure they are error-free. This can be done for free annually by going to annualcreditreport.com or by calling 800-322-8228.

The survey was conducted by the Engine Telephone CARAVAN survey, who on April 25-28, 2019, interviewed 1,002 representative adult Americans by landline or cell phone. The survey’s margin of error is plus or minus three percentage points.

Please see a detailed overview of the historical results for the Credit Score Knowledge Survey at www.VantageScore.com/CreditScoreKnowledge19.

Percentage of Respondents with Correct Answers

| Topic | Correct Answer(s) | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |||||||||

| Who uses scores? | Credit card issuers | 90 | 89 | 88 | 89 | 87 | 85 | 85 | 82 | |||||||||

| Mortgage lenders | 94 | 87 | 87 | 88 | 88 | 85 | 84 | 83 | ||||||||||

| Landlords | 73 | 69 | 70 | 72 | 70 | 67 | 71 | 65 | ||||||||||

| Cell phone companies | 66 | 61 | 61 | 62 | 68 | 59 | 58 | 59 | ||||||||||

| Home insurance | 71 | 64 | 67 | 66 | 66 | 62 | 61 | 58 | ||||||||||

| What factors are used to calculate scores? | Miss payments | 94 | 90 | 92 | 92 | 91 | 91 | 86 | 86 | |||||||||

| High balances on credit cards | 89 | 85 | 87 | 86 | 85 | 86 | 81 | 78 | ||||||||||

| Personal Bankruptcy | 90 | 86 | 87 | 88 | 86 | 85 | 79 | 71 | ||||||||||

| Who collects info for scores? | Credit bureaus | 75 | 71 | 72 | 70 | 68 | 64 | 68 | 66 | |||||||||

| Do consumers have more than one score? | More than one score | 78 | 71 | 72 | 70 | 69 | 67 | 68 | 62 | |||||||||

| When are lenders required to disclose a credit score? | When a loan is rejected | 79 | 76 | 76 | 78 | 78 | 78 | 67 | 64 | |||||||||

| After loan application | 80 | 73 | 75 | 77 | 75 | 75 | 62 | 62 | ||||||||||

| When a consumers doesn't receive the best terms | 70 | 65 | 66 | 67 | 69 | 66 | 56 | 54 | ||||||||||

| How do you raise a low score/maintain a high credit score? | Make loan payments on time | 97 | 94 | 95 | 97 | 95 | 96 | 89 | 87 | |||||||||

| Keep credit card balances under 25% | 85 | 74 | 76 | 78 | 78 | 80 | 72 | 66 | ||||||||||

| Avoid opening several accounts at once | 83 | 72 | 72 | 72 | 73 | 74 | 66 | 62 | ||||||||||

| Is it important to check credit report accuracy? | Very important | 82 | 74 | 72 | 74 | 73 | 68 | 67 | 67 | |||||||||

| What agency is best for resolving a complaint? | CFPB | NA | NA | 74 | 73 | 72 | 73 | 68 | 66 | |||||||||

| Are credit repair companies usually or never helpful? | Never | 46 | 57 | 55 | 53 | 54 | 47 | 44 | 44 | |||||||||

| Average score for key knowledge questions | 80 | 75 | 76 | 76 | 76 | 74 | 70 | 67 | ||||||||||

| Seen credit score(s) in the past year | 42 | 45 | 49 | 51 | 54 | 56 | 57 | 55 | ||||||||||

| Consider knowledge excellent/good | 54 | 54 | 55 | 57 | 50 | 58 | 59 | 60 | ||||||||||

The Consumer Federation of America is an association of more than 250 non-profit consumer groups that, since 1968, has sought to advance the consumer interest through research, education, and advocacy.

VantageScore Solutions, initially developed by America’s three national credit reporting companies (CRCs) – Equifax, Experian, and TransUnion – is the independently managed company behind the VantageScore credit scoring model.

Contacts

Jack Gillis, 202-939-1018

Jeff Richardson, VantageScore Solutions

203-363-2170

Copyright © acrofan/Business Wire All Right Reserved

[CES 2021] LG Emphasized "Needs to Innovate Beyond..

[CES 2021] LG Emphasized "Needs to Innovate Beyond.. [CES 2021] Sony Unveiled Its Latest Initiatives Sur..

[CES 2021] Sony Unveiled Its Latest Initiatives Sur.. Macan sets new standards: the first all-electric S..

Macan sets new standards: the first all-electric S.. Putting the new Macan through its paces in the nam..

Putting the new Macan through its paces in the nam.. G-Star 2019 : Global Game Exhibition for the Whole..

G-Star 2019 : Global Game Exhibition for the Whole.. 2019 LoL Champions Korea Spring Media Day

2019 LoL Champions Korea Spring Media Day DISNEY+ Showcases Ambitious New Content Slate from..

DISNEY+ Showcases Ambitious New Content Slate from.. eCommerce leader Coupang Dives into Video Streamin..

eCommerce leader Coupang Dives into Video Streamin..